Finance charges are one of the main ways that banks make money off of your transactions. In this article, we will take a look at what finance charges are, and how to avoid them when conducting business with a bank.

A finance charge is a fee that banks, credit unions, and other lending institutions charge when you borrow money. There are a few things to keep in mind if you want to avoid paying a finance charge. First, make sure you read the fine print when you sign up for a loan – some loans have hidden finance charges that you don’t know about until after you’ve already signed the contract.

Second, always ask your bank or credit union about any financing options that might be available to you. If you can’t find a suitable loan on the spot, be sure to ask your bank or credit union if they can help you get pre-approved for a loan in the future. Finally, try to stick to low-interest loans when possible – this will help reduce your finance charges overall.

What Is a Finance Charge and How Do I Avoid It?

A finance charge is a fee charged by a lender or credit card company when you borrow money. This fee can be charged as part of the interest rate on your loan, or it can be added to the cost of your credit card. A finance charge is a fee that banks and other lenders charge for borrowing money. It is usually assessed as a percentage of the total amount borrowed, and it is usually capped at a certain amount.

What is a finance charge?

Most banks will calculate your finance charge based on your credit score, the terms of your loan, and the interest rate you are borrowing at.

If you are interested in avoiding a finance charge, be sure to ask your bank about its policies regarding financing. You may also want to shop around for loans before settling on one.

Be sure to read your loan agreement carefully, as there may be specific terms related to finance charges that you need to be aware of.

What Does a Finance Charge Include?

A finance charge is a fee that banks and other lenders charge for borrowing money. Finance charges can vary from lender to lender, but they generally include an interest rate, convenience fees, and other charges. To avoid finance charges, be sure to compare rates before shopping for a loan.

How Do Finance Charges Work?

A finance charge is a fee that banks and credit unions charge for borrowing money. The fee is usually a percentage of the amount borrowed, and it’s usually assessed when you make a purchase with a credit card, refinance a loan, or borrow money from an ATM. Finance charges can be expensive, so it’s important to understand how they work and how to avoid them.

When you borrow money from a bank or credit union, the institution will likely require you to provide proof of income (such as a pay stub or tax return). The institution will also calculate your APR (annual percentage rate), which is the interest rate you’ll be charged on your loan. Your APR will depend on your credit score and other factors.

If you make a purchase with a credit card, the bank or credit union will likely charge you a finance charge as part of the purchase price. The finance charge is essentially a fee for using your credit card. This fee can be quite high, so it’s important to read the terms and conditions of your credit card agreement carefully before making any purchases.

If you refinance a loan, the bank or credit union might also charge you a finance charge as part of the refinance process.

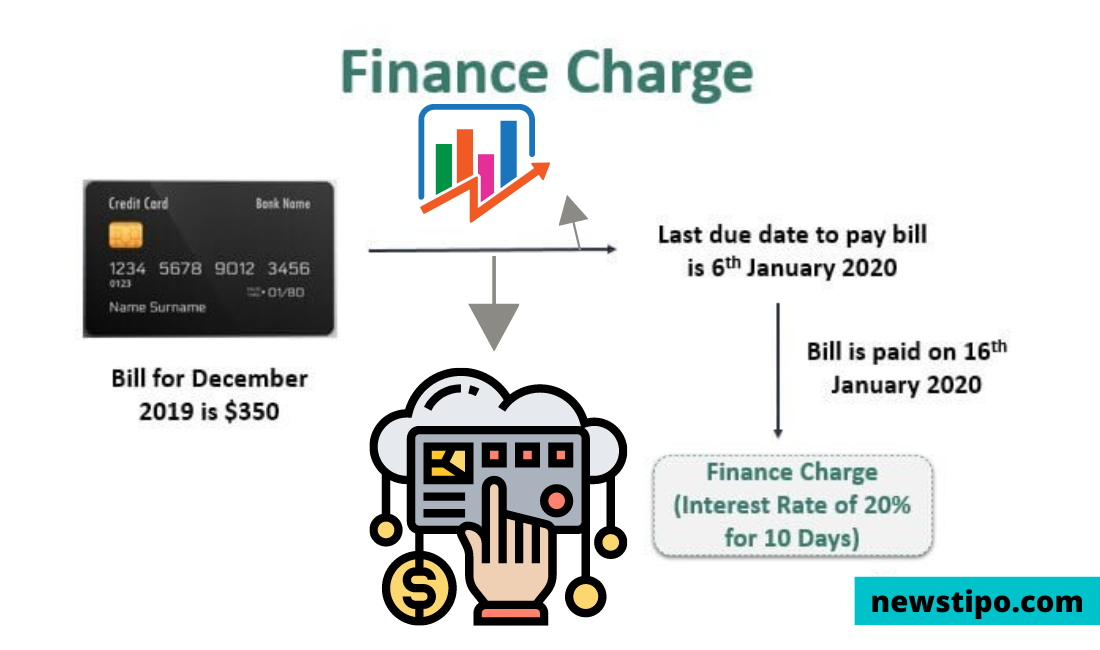

Finance charge example

A finance charge is a fee levied by a lender on a loan. The fee is typically a percentage of the total amount of the loan and is designed to cover the costs associated with the loan. Finance charges can be expensive, so it’s important to avoid them if possible.

Here are some tips for avoiding finance charges:

1. Shop around for loans. There are many different lenders out there, and each charges different rates for loans. Try getting quotes from several different providers to get an idea of how much you could save.

2. Compare interest rates. Sometimes lenders will offer lower interest rates if you take out a longer loan term. This can be helpful if you’re budgeting for a large purchase and don’t want to pay high-interest rates right off the bat.

3. Get pre-approved for a loan. This will help you determine how much money you’ll need to put down and eliminate any surprises when you go to apply for a loan.

4. Pay off your debt as quickly as possible. A low balance on your credit score can improve your borrowing prospects in the future, so it’s important to pay off your debts as quickly as possible. This will also reduce your overall payment burden.

5. Shop for a low-interest loan. Some lenders offer loans with low-interest rates, which can be a great option if you have a low credit score.

What Is a Finance Charge on a Credit Card?

A finance charge is a fee that lenders charge when you borrow money. This fee can be a percentage of the amount you borrow, or it can be an amount that’s added to your loan amount. Some cards also have annual fees associated with them. You can avoid finance charges by paying your balance in full each month.

How do I avoid finance charges?

When you make a purchase with your credit card, the merchant may charge a finance charge. Finance charges are usually expressed as a percentage of the purchase price. For example, if you spend $100 on a purchase that costs $120, the merchant may charge you a finance charge of 9%.

There are several ways to avoid finance charges. The easiest way is to only use your credit card for transactions that you can afford to pay in full immediately. If you need to borrow money to make a purchase, consider using a loan product such as a credit card cash advance.

Don’t Miss …

Finally, always read the terms and conditions of your credit card before making a purchase. This will help you understand whether or not there are any finance charges associated with the transaction.

Finance Charges Disclosed

A finance charge is a fee that lenders charge for borrowing money. A finance charge may be assessed on a loan amount, the length of the loan, or both. Finance charges are often assessed as part of the interest portion of a loan, although they may also be assessed separately.

Below is a list of tips to avoid finance charges:

– Shop around for loans: Compare interest rates and fees associated with different types of loans. There are many online resources available to help you do this.

– Ask about finance charges up front: Be sure to ask your lender what type of finance charge(s) will apply to your loan. Many lenders will offer you the option to have your finance charge(s) waived if you take out a variable-rate loan.

– Pay off your loan as soon as possible: If you can afford to do so, make every effort to pay off your loan in full as soon as possible. This will minimize your total interest payments and potentially reduce your overall finance charge.

What are the effects of finance charges on my credit score?

Finance charges are fees that lenders charge for loans or credit cards. Lenders may also charge a finance charge when you take out a home loan, refinance a loan, or set up a new credit card. Finance charges can have a big impact on your credit score.

The interest that you pay on your debt is divided among all the creditors who hold debts on your account. The amount of interest you pay is largely determined by how much is borrowed and the terms of the loan, such as the APR (annual percentage rate). The less money you borrow and the shorter the term of the loan, the lower your interest rate will be.

Lenders may add an annual percentage rate (APR) to your debt from time to time in order to make money. This is called an adjustment fee and it can significantly increase the amount of interest that you pay over time. The interest payments that you make each month are then compared to your total outstanding debt including both principal and interest. Any excess payments go to pay off your principal balance faster, not to cover any additional interest that may have accrued since your last payment date.

If your total outstanding debt exceeds 120% of your annual income, lenders may consider you to be in a high-debt category and may reduce the credit score that is associated with your file. This could make it more difficult for you to get approved for future loans or credit cards.